Describe the Purpose and Steps of the Bank Reconciliation

A bank reconciliation is used to compare your records to those of your bank to see if there are any differences between these two sets of records for your cash transactions. A bank reconciliation statement is a document that compares the cash balance on a companys balance sheet Balance Sheet The balance sheet is one of the three fundamental financial statements.

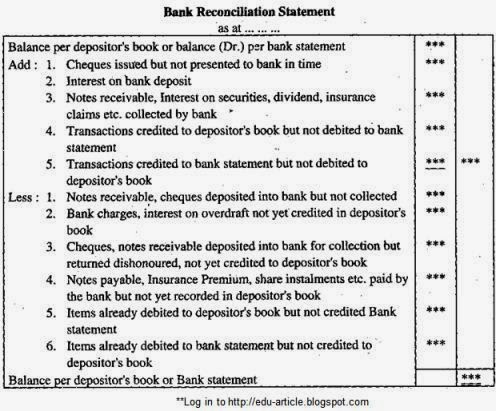

Bank Reconciliation Statement Brs Format And Steps To Prepare

The statement also includes bank charges such as for account servicing fees.

. This is a major step in the bank reconciliation process. Add deposits in transit. The reconciliation statement will include the.

This involves arriving at one balancesay balance as per bank after making necessary adjustements to the other balanc View the full answer. Get Bank Records and Business Records. Add them to the bank balance.

What is a Bank Reconciliation. A bank reconciliation is the matching of the bank balance in the books of an organisation with that of the statement from the bank. Might not be replaced.

There are nine steps to completing a bank reconciliation manually. Gather your bank statement general ledger and bank reconciliation documents for the month youre auditing. The ending balance of your version of the cash records is known as the book balance while the banks version is called the bank balance.

To the corresponding amount on its bank statement. It will also highlight any transactions initiated by the bank which have not yet been recorded in the business accounting records. In your own words explain the purpose and timing of the process of bank reconciliation.

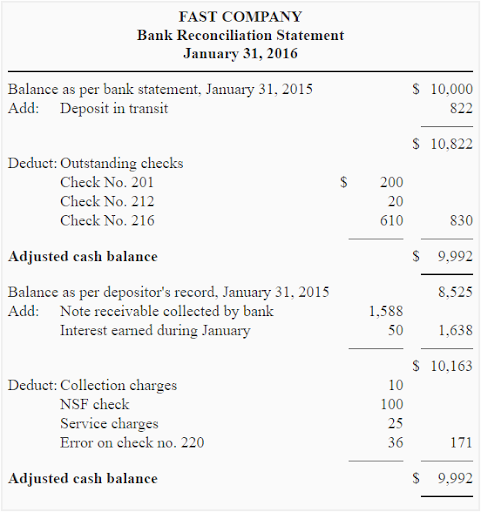

Begin with adjusting the banks balance. The financial statements are key to both financial modeling and accounting. C Start from there where your books matched the balance in your bank accoun View the full answer.

Once youve received it follow these steps to. Here are the steps for completing a bank reconciliation. Moreover some random errors like noting wrong entries to the data etc.

Start with the ending cash balance per the bank statement. Completing a regular reconciliation of all bank accounts helps to bring attention to variances errors and fraudulent activity on the account. The bank reconciliation is useful in proving the accuracy of the Cash account in the general ledger.

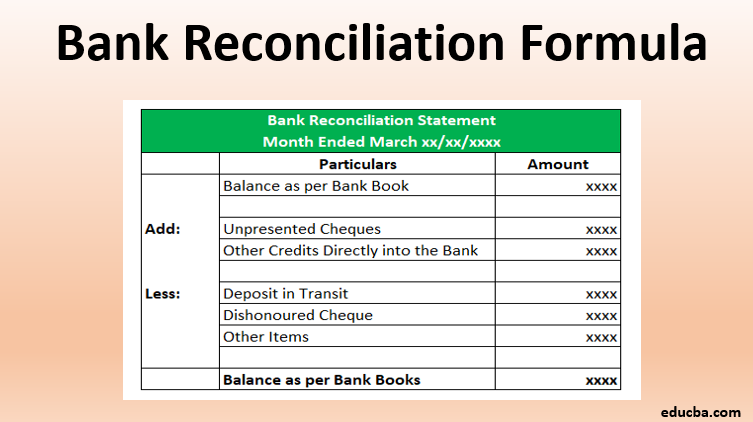

A bank reconciliation is the balancing of a companys cash account balance to its bank account balance. 5 simple steps which can help your bank account reconciliation. Adjust the bank statements.

According to Accounting Tools the purpose of a bank reconciliation is to compare the banks records of transactions for an account with the account holders records. Find a place to start. The deposits in transit are all deposits made at the end of the period that are not on the bank statement because of the timing of the statements printing.

The bank reconciliation is an internal document prepared by the company that owns the checking account. Describe the purpose and steps of the bank reconciliation. Chapter 6- steps in preparing the bank reconciliation.

B Collect business records through logbook or spreadsheet. Bank Reconciliation Statement is as necessary as a bank statement for a cash account. Check the income and expenses in your books.

Checklist for An In-House Bank Reconciliation Audit. The statement itemizes the cash and other deposits made into the checking account of the business. Ad Software Provides Reconciliation From Virtually Any File Source.

The transactions with timing differences are used to adjust and reconcile both the bank and company balances. Identify and list any unrecorded deposits and any bank errors understating the bank balance. How to complete a bank reconciliation procedure.

Describe the purpose and steps of the bank reconciliation. Identify the bank statement balance of the cash account balance per bank. In order to prepare the reconciliation there.

Prepare your reconciliation form. Before you start you need to gather the following information. The check sequence summary of.

Compare the final figures on your reconciliation document to that accounts bank statement. It records necessary changes mandatory to declare the bank statement and cash book records error-free and hence required. The bank reconciliation is the internal financial report that explains and documents any differences that may exist between the balance of a checking account as reflected by the banks records bank balance for a company and the companys accounting records company balance.

The amounts should match. In your own words explain the purpose and timing of the process of bank reconciliation. Steps involved in bank reconciliation are - a Get bank records through online banking or by a bank statement.

Enter dates and balances in the bank reconciliation template correctly All the dates and bank balances must be entered correctly. With each transaction your bookkeeper accountant or accounting software records bank and cash transactions. A bank statement is reconciled by comparing it to the general ledger within your business.

Compare the end balances. You will need to get that from your online banking account a statement or have the bank send the data to your accounting software. A list of transactions from the bank.

Check the final figures on your bank reconciliation document. Gather your business records. To make the process easier consider the following bank reconciliation steps.

Carefully enter all outstanding checks The outstanding checks must be entered properly. Below is a good example of a simple reconciliation form. December 17 2021.

You receive a bank statement typically at the end of each month from the bank. Adjust the cash balance. For example your bank.

Your bank reconciliation form can be as simple or as detailed as you like. We must reconcile the balance of the banks records and the Cash account in the general ledger and explain or account for any differences in the two. The purpose of bank reconciliation statement is to carried out uncover and correct any errors in the recording of payments made from the bank account and amounts lodged to the bank account.

The bank column displays whats available in the bank and the cash column depicts what cash is available. Go over your bank deposits and withdrawals. After the bank reconciliation is prepared accurately both the bank balance and the company balance will be the same amount.

Bank Reconciliation Statement Definition Types Template

No comments for "Describe the Purpose and Steps of the Bank Reconciliation"

Post a Comment